Mainstar Trust will be posting a series of blogs in 2020 to provide you with details about SECURE Act provisions that could affect your IRA or small business retirement plan. This is the second in the series and addresses the change in beneficiary distribution options, including elimination of the stretch IRA strategy for most non-spouse beneficiaries. Although these changes apply to IRAs and employer retirement plans, this blog will focus on IRAs.

The new rules could affect how some IRA owners choose to name beneficiaries for their IRAs or other aspects of their estate plan. If you have questions about how your IRA beneficiaries might be affected, or you have recently inherited retirement assets, you may want to seek professional financial planning or tax advice.

The Old Rules - Before the SECURE Act

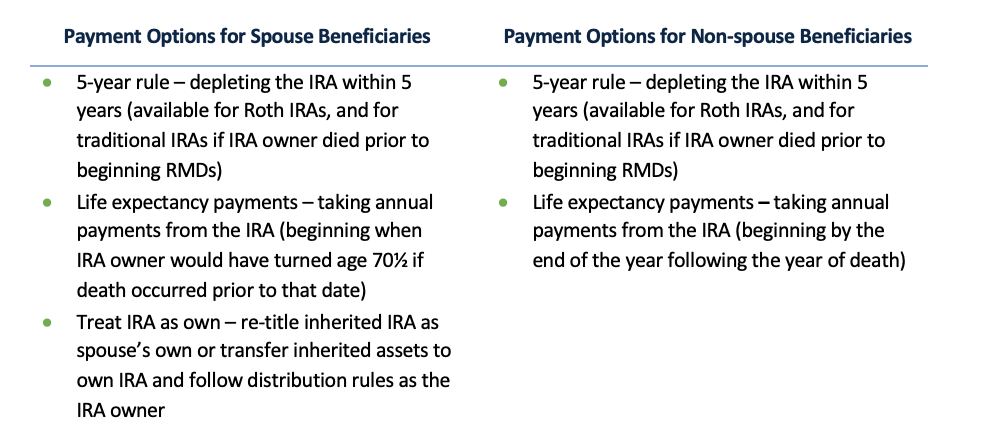

Tax laws require beneficiaries who inherit IRA assets to distribute the account balance within a certain time frame but provide multiple payment options. The options available to each beneficiary depend on whether the IRA owner had begun taking required minimum distributions (RMDs) before death and whether the beneficiary was a spouse of the IRA owner. (The payment rules for non-person beneficiaries, such as an estate or trust, are not covered in this blog.)

Under the life expectancy payment option, a beneficiary must withdraw at least a minimum amount each year, which is calculated using a life expectancy factor specified in the IRS’s Single Life Expectancy Table. Beneficiaries could always withdraw more than the minimum required, but by taking only the minimum amount each year, beneficiaries could reduce the tax impact of their inheritance and allow the assets to continue growing tax-deferred for as long as possible – many professionals refer to this as the stretch IRA strategy. In some cases, this strategy could be used to pass on inherited assets to multiple generations.

The New Rules - After the SECURE Act

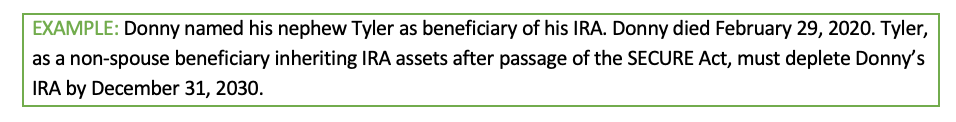

The SECURE Act changes the beneficiary payment options to eliminate the five-year rule and the stretch strategy for most non-spouse beneficiaries. Under the new rules, the only payment option for these beneficiaries is to deplete the IRA by the end of the 10th year following the year of death. Beneficiaries may take payments at will during this 10-year period, as long as the IRA is depleted in 10 years.

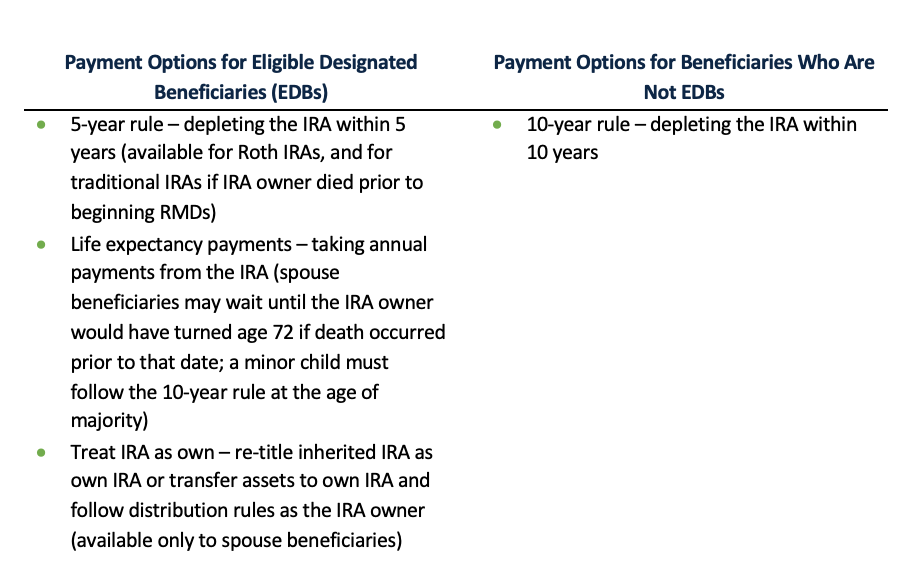

These new rules apply to beneficiaries of IRA owners who died on or after January 1, 2020, unless the beneficiary is an eligible designated beneficiary (EDB). Beneficiaries who qualify as an EDB generally have all the payment options under the rules that applied before the SECURE Act, including the stretch IRA strategy (special rules apply for minor children).

Eligible Designated Beneficiaries (EDBs) – A beneficiary is an EDB if, as of the date of the IRA owner’s death, they are one of the following:

- Surviving spouse of the IRA owner

- A child of the IRA owner who has not reached the age of majority (when the child reaches the age of majority, the 10-year rule applies)

- Disabled individual (based on IRC Section 72(m)(7), generally, unable to engage in substantial gainful activity due to physical or mental impairment, likely to be of long duration)

- Chronically ill individual (based on IRC Section 7702B(c)(2), generally, unable to perform at least two of six activities of daily living for an indefinite and lengthy period)

- Non-spouse beneficiary who is not more than 10 years younger than the IRA owner (common examples may include siblings and friends)

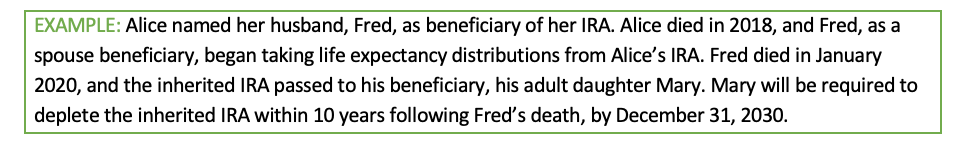

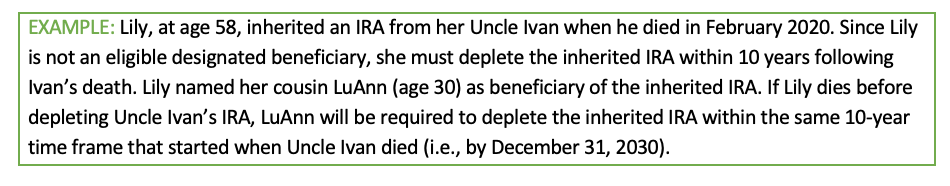

Successor Beneficiaries – If a beneficiary who has inherited IRA assets dies before depleting the inherited IRA, the new 10-year payout rule will generally apply to their successor beneficiary. If the original beneficiary was an EDB, the successor beneficiary may apply the 10-year rule from the date of the original beneficiary’s death.

If the original beneficiary was not an EBD, the successor beneficiary must distribute the inherited assets within the original 10-year period that began with the account owner’s death.

More to Come

The new rules as explained in this blog are based on current interpretations of the statutory language. The industry anticipates additional regulatory guidance from the Treasury Department clarifying the changes and providing instructions on how to implement these new rules. Mainstar Trust will follow up with more details as they become available.