Almost everyone expects to receive Social Security benefits in retirement. It’s a complex system that depends on workers paying in during their working years to support current retirees’ benefits, as well as disability and survivor benefits. In 2019, about 64 million Americans received over $1 trillion in Social Security benefits.1 Under the current rules, a variety of factors can affect your benefits. Here are the top 10 things you should know about Social Security retirement benefits as you consider the best time to begin receiving benefits. A financial advisor or planner can help you evaluate your options.

1. Your benefit is dependent on your lifetime earnings

You earn credits toward your eligibility to receive Social Security retirement benefits by working and having Social Security taxes withheld from your paychecks. You generally need to work the equivalent of 10 years over your lifetime to qualify for benefits.2 Your benefit payment is calculated based on your highest 35 years of earnings. Higher lifetime earnings result in higher benefit payments.

2. Your employer pays into Social Security on your behalf

Your employer withholds 7.65% of your earnings each paycheck and remits that amount to the federal government: 6.2% goes toward Social Security and 1.45% goes to Medicare.3 Your employer must also kick in an amount equal to 7.65% of your compensation to Social Security/Medicare. If you are self-employed, you pay the whole 15.3% yourself. There is a cap on compensation that is subject to the Social Security tax, however, ($137,700 for 2020).

3. The maximum benefit is double the amount the average worker receives

After the 1.6% cost-of-living adjustment for 2020, the average monthly benefit for retired workers is $1,503 per month and $2,531 for a married couple both receiving benefits. The maximum monthly benefit per individual is $3,011.3

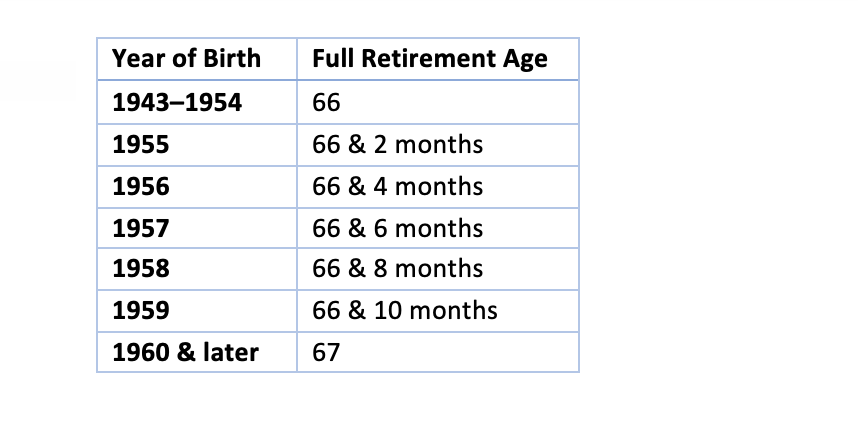

4. Your full retirement age is 67 if you were born in 1960 or later

The age at which a worker can receive full Social Security retirement benefits has been gradually increasing from age 65 to 67.

5. Your benefits will be permanently reduced if you claim early

You can claim your Social Security benefits as early as age 62 but taking benefits before your full retirement age will permanently reduce your monthly benefit by a fraction of a percent for each month before your full retirement age. This means that if you begin receiving benefits at age 62, your monthly benefit will be approximately 25–30% lower than if you waited until your full retirement age.4

6. Spousal benefits are complicated

Spouses who have low lifetime earnings can receive up to 50% of their spouse’s full benefit. The spouse’s own benefit is calculated first, then any amount over the spouse’s own benefit up to 50% of the spousal benefit will be added.2 To make a claim for spousal benefits, both spouses must be at least age 62 and the “worker” spouse must have already filed for benefits. If the working spouse has not yet reached full retirement age, benefits paid to both spouses will be reduced based on the age of the worker spouse. Special rules apply if you are divorced or widowed.

7. You can increase your benefits by delaying your claim

If you delay claiming benefits until after you reach full retirement age, your monthly benefit payments will increase by 8% for each year benefits are delayed beyond full retirement age until you reach age 70.2

8. Social Security was designed to be a supplement

Social Security replaces approximately 40% of preretirement income for the average worker and about 27% for high earners.2 Most financial advisers say you will need about 70% of your pre-retirement income to live comfortably in retirement.

9. You might have to pay taxes on your benefits

If you are married filing a joint tax return, you will have to pay taxes on up to 50% of your Social Security benefits if your combined annual income is between $32,000–$44,000. If your combined income is more than $44,000, up to 85% of your Social Security benefits are subject to income tax. For individual filers, these limits are $25,000–$34,000.2 Taxable distributions from your IRAs and retirement plans count toward your income for this calculation.

10. You can calculate what your benefit will be at different ages

You can find out more about Social Security retirement benefits and get an estimate of your benefits at www.ssa.gov. The Social Security Administration also offers several calculators that allow you to estimate how changing your claiming age or your lifetime earnings will affect your monthly retirement benefit, as well as your spouse’s benefit.

Sources:

1 Social Security Administration, Fact Sheet Social Security, https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

2 Social Security Administration, Retirement Benefits, Publication No. 05-10035, 2019, https://www.ssa.gov/pubs/EN-05-10035.pdf

3 Social Security Administration, Fact Sheet: 2020 Social Security Changes, https://www.ssa.gov/news/press/factsheets/colafacts2020.pdf

4 Social Security Administration, Retirement Planner: Benefits By Year of Birth webpage, https://www.ssa.gov/planners/retire/agereduction.html